Commercial real estate is property used for business purposes. Many new investors are curious about this market because it offers steady income and long-term value. Understanding the basics helps you decide if commercial real estate is right for your investment goals.

What Counts as Commercial Real Estate

Commercial real estate includes buildings and land used to make money. Common types include office buildings, retail stores, warehouses, apartment complexes, and mixed-use properties. Unlike residential real estate, these properties are leased to businesses or multiple tenants instead of single families.

How Commercial Real Estate Makes Money

Commercial properties earn income mainly through rent. Tenants sign leases that often last several years. Longer leases provide more stable income compared to residential rentals. Some leases also require tenants to help cover costs such as maintenance, insurance, and property taxes.

Types of Commercial Properties

There are several main categories of commercial real estate:

- Office: Buildings used for professional work

- Retail: Stores, restaurants, and shopping centers

- Industrial: Warehouses and distribution centers

- Multifamily: Apartment buildings with five or more units

- Mixed-use: Properties with both residential and commercial space

Each type has different risks, costs, and returns.

Why Investors Choose Commercial Real Estate

Many investors choose commercial real estate for higher income potential. Rent is often higher than residential property, and tenants may take better care of the space. Commercial properties also tend to increase in value over time when managed well.

Risks to Consider

Commercial real estate is not risk-free. Vacancies can last longer, and repairs may cost more. Economic changes can affect businesses and rental demand. This is why research and planning are important before investing.

Location and Market Matter

Location plays a big role in success. Strong local economies, good traffic flow, and nearby businesses attract better tenants. Market knowledge helps investors avoid overpaying and choose properties with growth potential.

Financing Is Different

Loans for commercial real estate often require larger down payments and stricter approval. Lenders focus on the property’s income, not just the buyer’s credit. Understanding financing options is key for beginners.

Professional Guidance Helps

New investors benefit from working with experts who understand the market. Guidance helps avoid mistakes and uncover better opportunities.

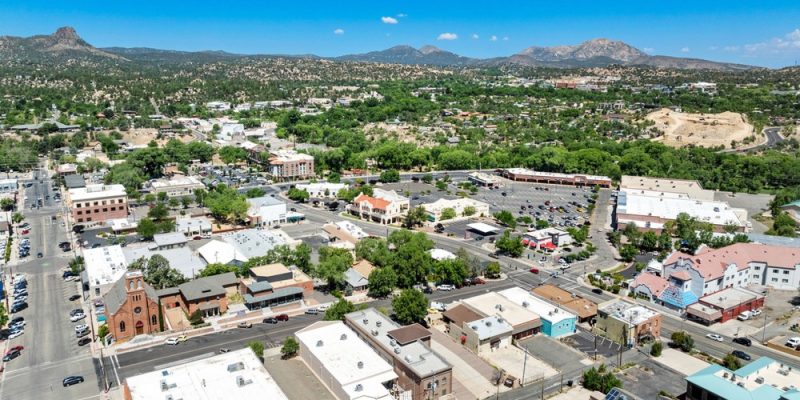

Arizona Commercial Real Estate Supports New Investors

At Arizona Commercial Real Estate, we help beginner investors understand commercial real estate step by step. We explain property types, income potential, and market trends in clear terms. By offering local insight and expert support, we help investors start with confidence and make informed decisions.

This post was written by a professional at https://www.arizonacre.com/. Arizona Commercial RE is a full-service commercial real estate brokerage in Prescott, AZ, specializing in sales, leasing, and property management. As one of the leading property management companies near you, we serve investors, landlords, tenants, and property owners throughout Northern Arizona. Our experienced brokers provide expert guidance across office, retail, industrial, and investment properties, making us a trusted choice for commercial real estate near you focused on maximizing value and performance.

Comments